USD/CAD Weekly Forecast: Markets Brace for Fed, BoC Pause…

- The USD/CAD weekly forecast signifies possible pauses from the Fed and BoC.

- The greenback collapsed in opposition to most of its friends amid optimism about commerce offers.

- Information revealed that US unemployment claims fell for the second week.

The USD/CAD weekly forecast signifies that merchants are gearing up for a pause by the Fed and the Financial institution of Canada.

Ups and downs of USD/CAD

The USD/CAD worth had a bearish week however closed effectively above its lows. At first of the week, the greenback collapsed in opposition to most of its friends amid optimism about commerce offers. A deal between the US and Japan assured traders that there is perhaps extra such offers earlier than the August 1 deadline. Consequently, threat urge for food soared and the greenback fell.

-Are you in search of one of the best CFD dealer? Verify our detailed guide-

Nonetheless, by Thursday, the main focus shifted to financial coverage. Information revealed that US unemployment claims fell for the second week. Consequently, Fed charge lower bets eased and the greenback rallied.

Subsequent week’s key occasions for USD/CAD

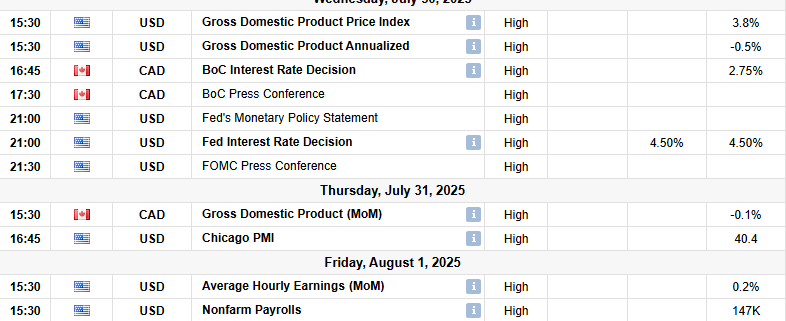

Subsequent week, merchants will give attention to main financial occasions, together with the US GDP, FOMC assembly, and the nonfarm payrolls report. In the meantime, Canada will launch its GDP report, and the Financial institution of Canada can even meet subsequent week.

A very powerful occasions would be the coverage conferences and the US employment report. The Fed will possible hold charges unchanged and preserve a cautious tone. The Financial institution of Canada can even proceed its pause. In the meantime, the NFP report will proceed shaping the outlook for Fed charge cuts.

USD/CAD weekly technical forecast: Triple backside, bullish divergence sign reversal

On the technical aspect, the USD/CAD worth has damaged above the 22-SMA, suggesting bulls are within the lead. On the identical time, the RSI has damaged above 50, suggesting stronger bullish momentum. Nonetheless, the worth stays in a good vary close to the 1.3575 key assist stage.

-In case you are occupied with assured stop-loss foreign exchange brokers, test our detailed guide-

On a bigger scale, USD/CAD is buying and selling in a corrective transfer after the downtrend paused close to the 1.3575 assist stage. Initially, the worth was making decrease highs and lows till it reached the assist stage. Right here, bears had been unable to interrupt beneath regardless of three makes an attempt. Consequently, the worth has made a triple backside.

Furthermore, the RSI has made a bullish divergence, indicating weaker bearish momentum. This means that the 1.3575 stage might mark a backside for the downtrend. Furthermore, bulls would possibly quickly get away of the tight consolidation to retest the 1.4000 key resistance stage.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It’s best to contemplate whether or not you possibly can afford to take the excessive threat of shedding your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!