USD/CAD Weekly Forecast: Financial Worries Mount Amid Tariffs…

- The USD/CAD weekly forecast factors to rising financial issues in Canada.

- Canada was one of many unfortunate nations to fail to signal a commerce take care of the US.

- Information revealed weak US job progress in July.

The USD/CAD weekly forecast factors to rising financial issues in Canada after Trump imposed increased tariffs.

Ups and downs of USD/CAD

The USD/CAD pair had a bullish week because the loonie weakened amid tariff issues. On the identical time, the greenback gained towards most of its friends, additional weighing on Canada’s foreign money. Canada was one of many unfortunate nations to fail to signal a commerce take care of the US. Consequently, tariff uncertainty weighed on the loonie till Trump introduced a 35% tariff on Friday. In the meantime, the tariff deadline boosted US Treasury yields and the greenback.

–Are you interested by studying extra about Bitcoin worth prediction? Verify our detailed guide-

Nevertheless, the Canadian greenback discovered some aid on Friday after information revealed weak US job progress and a rise within the unemployment fee.

Subsequent week’s key occasions for USD/CAD

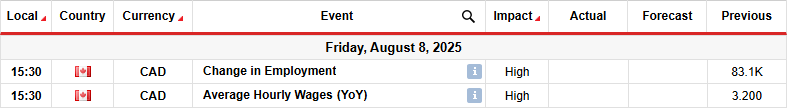

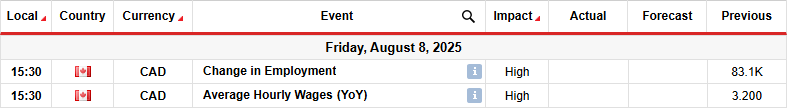

Subsequent week, Canada will launch its essential month-to-month employment report. Current information from the nation has proven a restoration after the Financial institution of Canada lowered borrowing prices. This has allowed the central financial institution to pause for some time. Subsequently, there’s a likelihood that employment will stay sturdy.

Nevertheless, Canada is now dealing with increased tariffs which may influence future financial progress. Subsequently, merchants can pay extra consideration to future studies.

USD/CAD weekly technical forecast: Value retests 1.3750 after bullish breakout

On the technical aspect, the USD/CAD worth has pulled again to retest the lately damaged 1.3750 key degree. It trades above the 22-SMA, and the RSI is above 50, suggesting a bullish bias. Subsequently, the retreat may solely be temporary earlier than the bullish transfer continues.

–Are you interested by studying extra about foreign exchange fundamentals? Verify our detailed guide-

The brand new course comes after the worth made a triple backside close to the 1.3575 key help degree. Initially, USD/CAD was on a downtrend and had simply made a brand new low. Nevertheless, the worth had stopped making vital swings from the SMA. Subsequently, it remained in a good vary and couldn’t break beneath 1.3575.

On the identical time, the RSI made increased lows, indicating a bullish divergence. The divergence was an indication that bearish momentum was fading. Consequently, bulls took over by breaking out of the tight vary. If they continue to be within the lead, the worth will probably retest the 1.4000 key psychological degree.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to think about whether or not you’ll be able to afford to take the excessive danger of dropping your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!