USD/CAD Weekly Forecast: Easing Tariff Tensions Weaken Greenback…

- The USD/CAD weekly forecast signifies greenback weak spot amid easing tariff tensions.

- Knowledge on Wednesday revealed that US shopper inflation rose by zero.5% in January.

- Reviews that Trump’s reciprocal tariffs wouldn’t come instantly boosted threat urge for food.

The USD/CAD weekly forecast signifies enhancing threat urge for food amid easing tariff tensions that hold stress on the greenback.

Ups and downs of USD/CAD

The USD/CAD pair had a bearish week because the greenback dropped from its peaks as a result of easing tariff fears. Initially of the week, merchants centered on Powell’s speech. The Fed Chair maintained his hawkish tone, saying there was no rush to decrease borrowing prices.

-In case you are eager about foreign exchange day buying and selling then have a learn of our information to getting started-

In the meantime, knowledge on Wednesday revealed that US shopper inflation rose by zero.5% in January, beating forecasts of zero.three%. The upbeat report led to declining Fed fee reduce expectations, briefly boosting the greenback. Nevertheless, studies that Trump’s reciprocal tariffs wouldn’t instantly increase threat urge for food, damage the US greenback. Moreover, knowledge on Friday revealed that US retail gross sales dropped greater than anticipated.

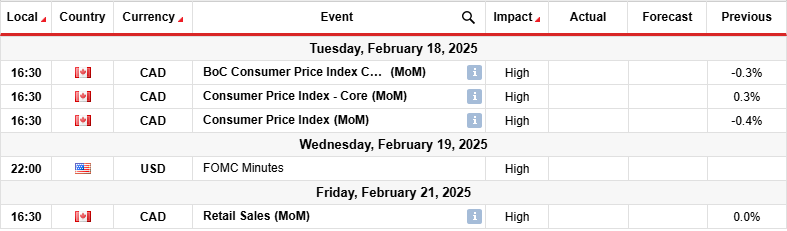

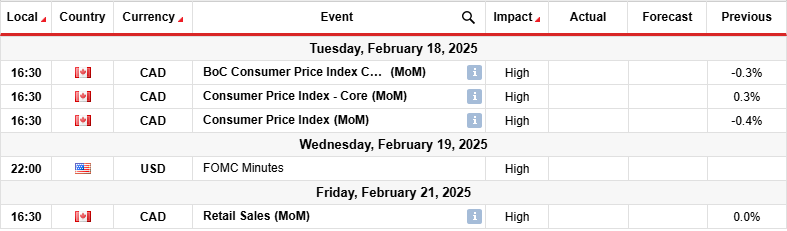

Subsequent week’s key occasions for USD/CAD

Subsequent week, buyers will monitor inflation and retail gross sales knowledge from Canada. In the meantime, the US will launch the FOMC coverage assembly minutes. Canada’s inflation studying will form the outlook for Financial institution of Canada fee cuts. An even bigger-than-expected quantity will decrease bets for a fee reduce, boosting the Canadian greenback. Then again, if inflation is softer than forecast, rate-cut bets will rise, hurting the loonie.

In the meantime, the FOMC assembly minutes will present the place policymakers stand on future fee cuts.

On the technical facet, the USD/CAD value has damaged under the 1.4300 assist degree, pushing decrease under the 22-SMA. The transfer comes after the worth made a strong bearish engulfing candle, signaling a possible reversal.

-Are you on the lookout for one of the best AI Buying and selling Brokers? Test our detailed guide-

Beforehand, USD/CAD traded in a robust uptrend, making increased highs and lows and respecting the 22-SMA as assist. Nevertheless, bears began gaining on bulls after the worth broke above the 1.4300 resistance degree. The value began making larger pink candles and stored near the 22-SMA. Nonetheless, bulls made one final try to remain in management by making a better excessive. Nevertheless, the RSI made a decrease excessive, displaying weaker bullish momentum.

Due to this fact, bears overpowered bulls and reversed the development, pushing the worth under the 22-SMA. Bears at the moment are eyeing the 1.4004 assist degree. A break under this degree will strengthen the brand new bearish bias.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to contemplate whether or not you may afford to take the excessive threat of dropping your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!