GBP/USD Weekly Forecast: Pound Finds Breather on Tariff Aid…

- The greenback collapsed when a 25% tariff meant for Canada and Mexico did not take off.

- The Financial institution of England lowered borrowing prices.

- Information on Friday confirmed a combined image of the US labor sector.

The GBP/USD weekly forecast signifies a short respite for the pound as Trump’s insurance policies weaken the greenback.

Ups and downs of GBP/USD

The GBP/USD pair had a bullish week regardless of a fee lower by the Financial institution of England. The rally got here from a decline within the greenback after Trump paused tariffs on Canadian and Mexican items.

–Are you curious about studying extra about STP brokers? Verify our detailed guide-

On Tuesday, the greenback collapsed when a 25% tariff meant for Canada and Mexico did not take off. The 2 nations negotiated higher commerce offers, giving them extra time. In the meantime, the Financial institution of England lowered borrowing prices however emphasised the necessity for warning as a consequence of excessive inflation. Lastly, knowledge on Friday confirmed a combined image of the US labor sector, with each jobs and the unemployment fee easing.

Subsequent week’s key occasions for GBP/USD

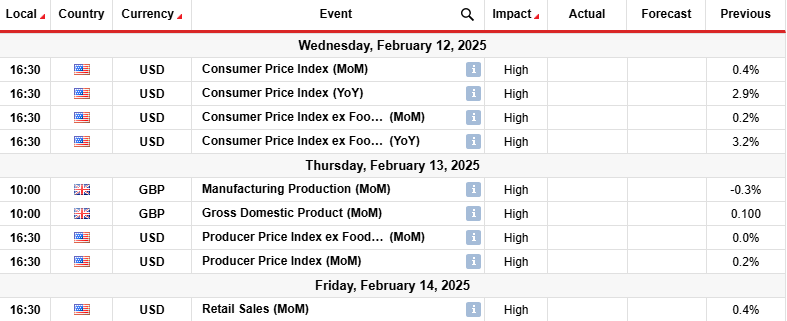

Subsequent week, market individuals will deal with inflation and retail gross sales knowledge from the US. In the meantime, the UK will launch figures on manufacturing manufacturing and GDP. The US client inflation report will form the outlook for Fed fee cuts.

Within the earlier month, the core CPI determine missed forecasts, indicating tender underlying worth pressures. Consequently, the greenback fell as fee lower expectations rose. One other month of cooler-than-expected inflation would possibly additional weigh on the greenback.

In the meantime, the UK GDP report will present the state of the UK financial system, which has been slowing down.

GBP/USD weekly technical forecast: Value briefly retreats after channel breakout

On the technical aspect, the GBP/USD worth has damaged out of its bearish channel, indicating a bullish shift in sentiment. The value now trades barely above the 22-SMA, displaying bulls are within the lead. Nonetheless, the RSI stays barely under 50, an indication that bearish momentum remains to be sturdy.

–Are you curious about studying extra about earning profits with foreign exchange? Verify our detailed guide-

GBP/USD has maintained a powerful downtrend, making decrease highs and lows and breaking previous key assist ranges. Nonetheless, bears paused when the value hit the 1.2200 assist stage. Right here, worth motion confirmed small-bodied candles with giant wicks, indicating indecision.

After that, bulls took cost by breaking above the channel resistance and the 22-SMA resistance. The value is presently retesting the SMA as assist. If bulls stay within the lead, the value will climb to the 1.2800 resistance. A break above this resistance would verify a brand new bullish pattern.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to take into account whether or not you’ll be able to afford to take the excessive danger of shedding your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!