EUR/USD Weekly Forecast: Fed Dovish Shift, EU Knowledge in Focus…

- The EUR/USD weekly forecast has turned bullish after the Fed Chair left dovish remarks concerning charge cuts.

- Constructive Eurozone PMIs restricted the draw back for the Euro.

- Markets eye macro releases from each the Eurozone and the US subsequent week.

The euro ended the week with a flurry of shopping for, with EUR/USD breaking by way of the 1.1700 stage after dropping to 1.1583 in the course of the week. The late rally got here on account of a steep decline within the US greenback after Fed Chair Powell delivered a dovish speech at Jackson Gap. He confirmed the primary charge reduce in September and launched a brand new coverage of versatile inflation focusing on. As merchants started to cost in a brand new easing cycle, the momentum within the greenback broke, correcting it to a extra impartial floor.

–Are you curious about studying extra about crypto robots? Examine our detailed guide-

The European facet of the story additionally helped the bulls. Flash PMI information in August indicated that the Eurozone economic system is gaining momentum, because the Composite PMI 51.1 was the very best in 15 months. Output within the manufacturing sector rose to a three-year peak, including to proof of a gradual therapeutic of the economic system as a complete.

The inflation studying held in keeping with anticipations, with the harmonized index of shopper costs (HICP) at 2& and the core quantity at 2.three% that demonstrates a way of stability. However Germany is once more a restraint on the outlook as revised Q2 GDP contracted zero.three% and Producer Costs have been weak, underscoring structural challenges in Europe.

Financial energy among the many greenback was first seen on the Antipodean-Asian entrance with upbeat weekly PMI figures, particularly with a producing resurge within the US. The info initially supported buck, however the pivot by Powell dwarfed the information and engendered a pointy turnaround in it. The markets are already pricing a near-certain September charge reduce, with extra speak of extra easing afterward within the present 12 months.

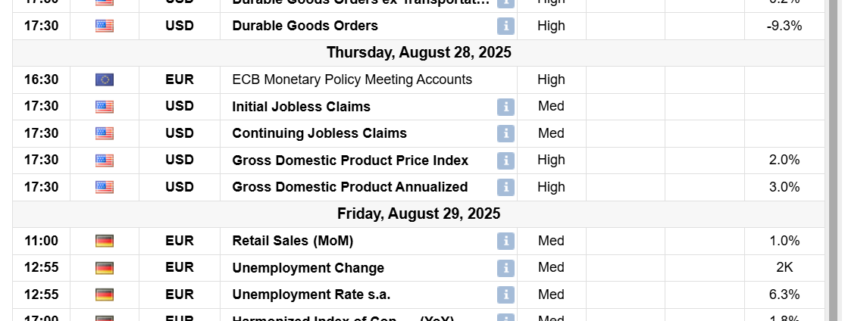

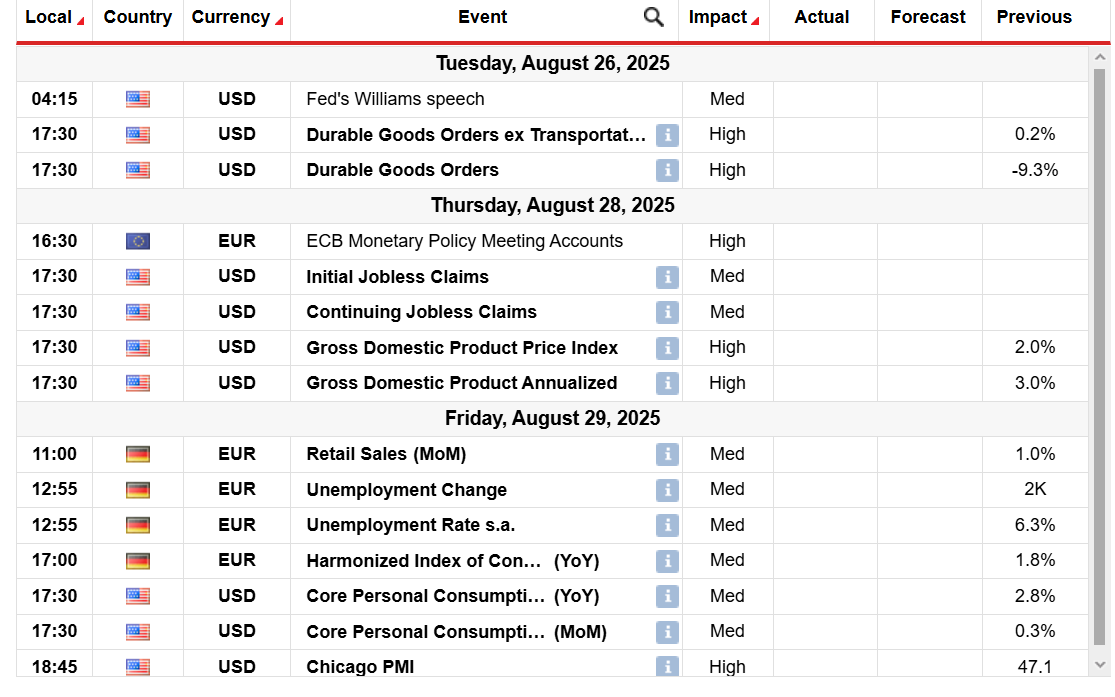

Going ahead, the primary occasions to watch are macro releases which will both again up this dovish perception or dispute it. Within the US, Sturdy Items Orders on Tuesday, Q2 GDP revision on Thursday, and the July Core PCE Value Index on Friday are on the radar. A draw back PCE print would see the greenback prolong its losses and push EUR/USD larger, with the inverse being true within the occasion of a stronger-than-expected information level.

In Europe, Germany might be within the limelight because the August IFO Enterprise Local weather survey, July Retail Gross sales, and preliminary HICP inflation are reported. Constructive German information could be a lift to the euro, though additional softness will restrict rallies. Moreover, the Financial Sentiment Indicator may even give a wider image of the restoration within the EU.

EUR/USD weekly technical forecast: Bulls eying 1.1800

The each day chart for EUR/USD exhibits a bullish bias as the worth broke above the confluence of 20- and 50-day MA close to 1.1650. The pair marked highs close to 1.1745, the place it noticed a light profit-taking. If the upside persists, the pair wants to search out acceptance above the 1.1750 resistance. The subsequent key stage emerges at 1.1800.

–Are you curious about studying extra about shopping for Dogecoin? Examine our detailed guide-

On the flip facet, the 100-day MA close to 1.1483 marks a key assist for the pair forward of 1.1400 (spherical quantity). Nonetheless, the each day RSI has sharply moved above the 50.zero stage, suggesting the trail of least resistance lies on the upside.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must think about whether or not you may afford to take the excessive threat of shedding your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!