AUDUSD Weekly Forecast: RBA Poised for a Charge Minimize…

- The AUD/USD weekly forecast factors to a possible RBA charge minimize on Tuesday.

- Markets interpreted Trump’s Fed alternative as dovish.

- US unemployment claims rose, fueling considerations concerning the labor market.

The AUD/USD weekly forecast factors to a possible RBA charge minimize on Tuesday that would drag the Australian greenback decrease.

Ups and downs of AUD/USD

Final week, the AUD/USD pair ended inexperienced because the greenback fell as a result of a rise in Fed charge minimize expectations. The greenback prolonged its declines from the earlier Friday, when the US launched a downbeat nonfarm payrolls report. On the similar time, markets interpreted Trump’s alternative within the Fed as dovish. Moreover, they anticipate Trump to interchange Powell after his time period ends with a extra dovish Chair.

–Are you to study extra about ECN brokers? Test our detailed guide-

In the meantime, knowledge through the week revealed weaker-than-expected enterprise exercise within the US companies sector. Individually, unemployment claims rose, fueling considerations concerning the labor market.

Subsequent week’s key occasions for AUD/USD

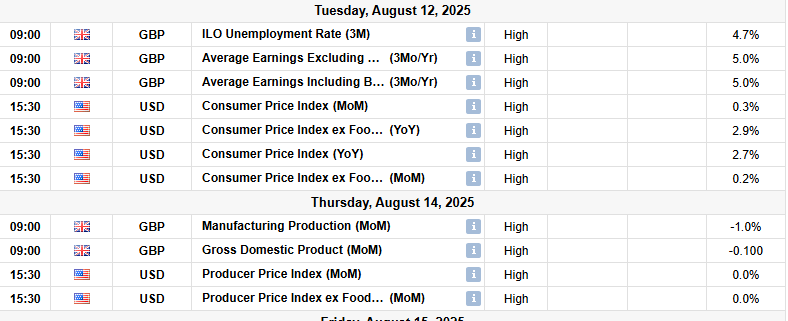

Subsequent week, market contributors will give attention to the Reserve Financial institution of Australia coverage assembly and employment figures from Australia. In the meantime, the US will launch figures on shopper and wholesale inflation. Furthermore, merchants will give attention to the US retail gross sales report.

Market contributors anticipate the RBA to chop charges on Tuesday by 25-bps. Moreover, they anticipate another charge minimize this yr. Subsequently, they’ll give attention to the messaging through the assembly. However, the US inflation knowledge will proceed to form the outlook for Fed charge cuts.

AUD/USD weekly technical forecast: Bulls problem SMA resistance inside consolidation

On the technical aspect, the AUD/USD worth has paused close to the 22-SMA resistance after bouncing from the zero.6425 key help degree. Furthermore, the value has remained in a sideways transfer between the zero.6425 help and the zero.6600 resistance ranges.

–Are you to study extra about day buying and selling brokers? Test our detailed guide-

Bulls have struggled to take care of their place above the 22-SMA. Nevertheless, after the final vary resistance contact, bullish momentum was weaker, and bears made a big swing under the SMA. However, it was not sufficient to begin a downtrend.

Bulls returned on the vary help and pushed the value to retest the SMA. A break above will permit bulls to retest the vary resistance. However, if the SMA holds agency, the value will probably bounce decrease to attempt to make a decrease low. Such an final result would affirm the beginning of a bearish development. Moreover, it might clear the trail to the zero.6201 help.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to think about whether or not you may afford to take the excessive threat of shedding your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!