AUD/USD Weekly Forecast: Dovish RBA Unable to Shake Bulls…

- The AUD/USD weekly forecast exhibits sturdy bullish sentiment.

- Powell emphasised the necessity for endurance relating to price cuts.

- US knowledge on Friday revealed dismal retail gross sales.

The AUD/USD weekly forecast is optimistic resulting from decreased commerce tensions regardless of anticipated RBA price cuts.

Ups and downs of AUD/USD

The AUD/USD pair had a bullish week because the greenback fell resulting from a delay on Trump’s reciprocal tariff. Nonetheless, there have been days when the US foreign money rose through the week. On Tuesday, Powell emphasised the necessity for endurance relating to price cuts. Moreover, knowledge on Wednesday revealed hotter-than-expected shopper inflation in January, which led to a decline in rate-cut bets.

-If you’re taken with foreign exchange day buying and selling then have a learn of our information to getting started-

Nonetheless, the Aussie rose in opposition to the greenback when it turned clear that Trump’s reciprocal tariffs wouldn’t come instantly. Furthermore, knowledge on Friday revealed dismal retail gross sales, indicating weak shopper spending.

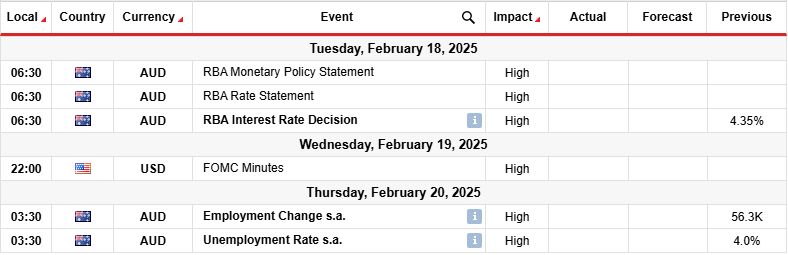

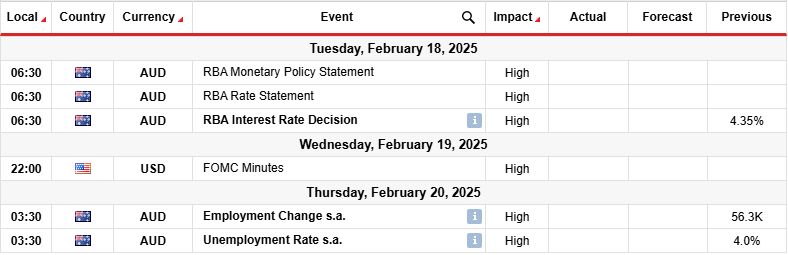

Subsequent week’s key occasions for AUD/USD

Subsequent week, merchants will deal with the Reserve Financial institution of Australia coverage assembly. Moreover, Australia will launch its month-to-month employment report. In the meantime, the US will launch the FOM coverage assembly minutes.

Most economists, as cited by Reuters, consider the RBA will lower rates of interest by 25-bps on Tuesday. This may be the primary price lower, indicating policymakers are assured inflation is on a path to the goal. Furthermore, a dovish tone through the assembly would damage the Australian greenback.

In the meantime, the FOMC assembly minutes will present what went into the final determination to maintain charges unchanged. Furthermore, it’d comprise clues about future strikes.

AUD/USD weekly technical forecast: Bullish momentum stronger above zero.63

On the technical facet, the AUD/USD value has damaged above the zero.6300 resistance degree to make a better excessive. Furthermore, the worth trades above the 22-SMA with the RSI above 50, supporting a bullish bias. The brand new excessive confirms a bullish reversal, which means the worth would possibly hold climbing.

-Are you in search of one of the best AI Buying and selling Brokers? Examine our detailed guide-

Initially, the worth was on a robust downtrend that paused beneath the zero.6300 assist degree. Right here, bears misplaced the passion to make important swings. On the similar time, whereas the worth made decrease lows, the RSI made increased ones, indicating fading momentum. This allowed bulls to resurface and push the worth above the 22-SMA.

Moreover, the worth broke above the zero.6300 resistance, confirming the bullish shift in sentiment. Subsequently, AUD/USD would possibly attain the following resistance at zero.6500.

Trying to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to take into account whether or not you may afford to take the excessive danger of shedding your cash.

Leave a Reply

Want to join the discussion?Feel free to contribute!